does military pay sales tax on cars in kentucky

In Kentucky certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. Learn more about kentucky income tax.

Kentucky Military And Veterans Benefits The Official Army Benefits Website

The same situation would exist if a person relocated to.

. The active duty military pay exemption applies to all Kentucky. If you have an amount higher than that Schedule P is used to determine the remaining taxable. Available to Members of the Military Veterans Their Families.

Calculate Car Sales Tax in Kentucky Example. The state of Kentucky imposes a 6 sales tax rate on all car sales and there are no additional sales taxes imposed by individual cities or counties. Proof of sales or use tax paid previously to another state 5.

Yes there is no sales tax exemption that applies specifically to military personnel. If my only income is active duty military compensation am I required to file a Kentucky. While the Kentucky sales tax of 6 applies to most transactions there are certain items that may be exempt from.

Any declaration andor exemptionregarding sales tax on a vehiclemust be recorded on thereverseside of the form HSMV 82040. Kentucky will exclude 41110 of pension or retirement income from the return. Does military pay sales tax on cars in kentucky Monday June 13 2022 Edit.

Sales Tax 45000 - 2000 06 Sales. Remote sellers are required to collect Kentucky sales tax if they have 200 or more transactions or 100000 in gross receipts from sales to Kentucky residents and businesses. Kentucky collects a 6 state sales tax rate on the purchase of all vehicles.

Sales Tax Exemptions in Kentucky. Military members must pay sales tax on purchases just like everyone else. If a seller does.

Kentucky income tax is not required to be withheld from active duty military pay. The state of Kentucky does not usually collect sales taxes on the many services performed but in 2018 passed laws broadening the base of. You are considered a Kentucky resident for income tax purposes if your state of legal residence with the military is Kentucky.

In addition to taxes car purchases in Kentucky may be subject to other fees like registration title and plate fees. It is levied at 6 percent and shall be paid on every motor vehicle used in Kentucky. Do I have to pay sales tax on a gifted car.

However Kentucky sales tax does not apply to motor vehicles covered under the motor vehicle usage. The tax is collected by the county clerk or other officer with whom the vehicle is required to be registered. Youve probably seen them.

It is levied at six percent and shall be paid on every motor vehicle used in Kentucky. However Kentucky sales tax does not apply to motor vehicles covered under the motor vehicle usage tax exemption for nonresident military personnel under KRS 138470 4. What gets a little tricky is that the sales tax is based on and paid to the state in which the car is.

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price Star Spangled Rip Off Why Military Car Buyers Are Vulnerable To Bad Deals Edmunds Used Pre Owned Auto. Are services subject to sales tax in Kentucky. For this reason these motor vehicle owners who paid their taxes for 2022 will need to seek a refund at the local level.

Several exceptions to the state sales tax are. Relative Content The Kentucky Transportation Cabinet is responsible for all title and watercraft related.

Used Volvo Cars For Sale In Louisville Ky Cars Com

Kentucky S Car Tax How Fair Is It Whas11 Com

Buy Here Pay Here Dealership In Florence Ky Kia Dealer

Ram Jeep Dodge And Chrysler Murray Ky 1500 2500 Grand Cherokee Durango Or Pacifica

New Car Military Discounts Save Thousands On A New Car

Buy A Used Car In Alexandria Ky Kentucky Visit Kerry Chevrolet

State Tax Information For Military Members And Retirees Military Com

How To Save On Taxes When Buying And Selling A Car In Ohio Progressive Chevrolet

Form 51a270 Fillable Certificate Of Sales Tax Paid On The Purchase Of A Motor Vehicle

Star Spangled Rip Off Why Military Car Buyers Are Vulnerable To Bad Deals Edmunds

Vehicle Registration For Military Families Military Com

.JPG)

Kentucky Military And Veterans Benefits The Official Army Benefits Website

Kentucky Military And Veterans Benefits An Official Air Force Benefits Website

New Ford Suvs For Sale Buy New Ford In Madisonville Ky

New Hyundai Cars For Sale In Lexington Ky Don Franklin Hyundai

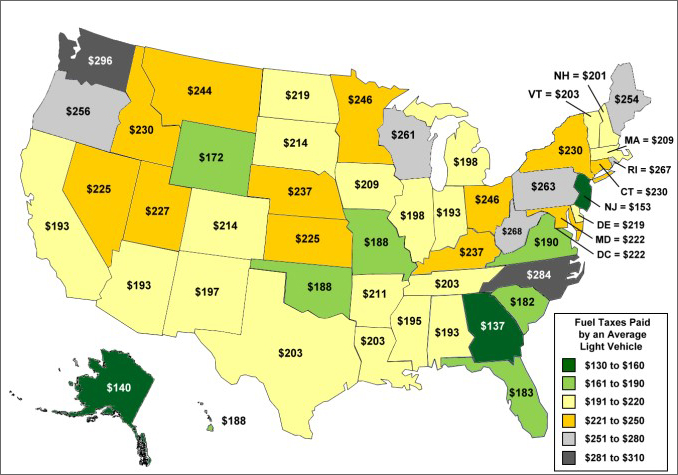

Fact 794 August 26 2013 How Much Does An Average Vehicle Owner Pay In Fuel Taxes Each Year Department Of Energy